Working Papers

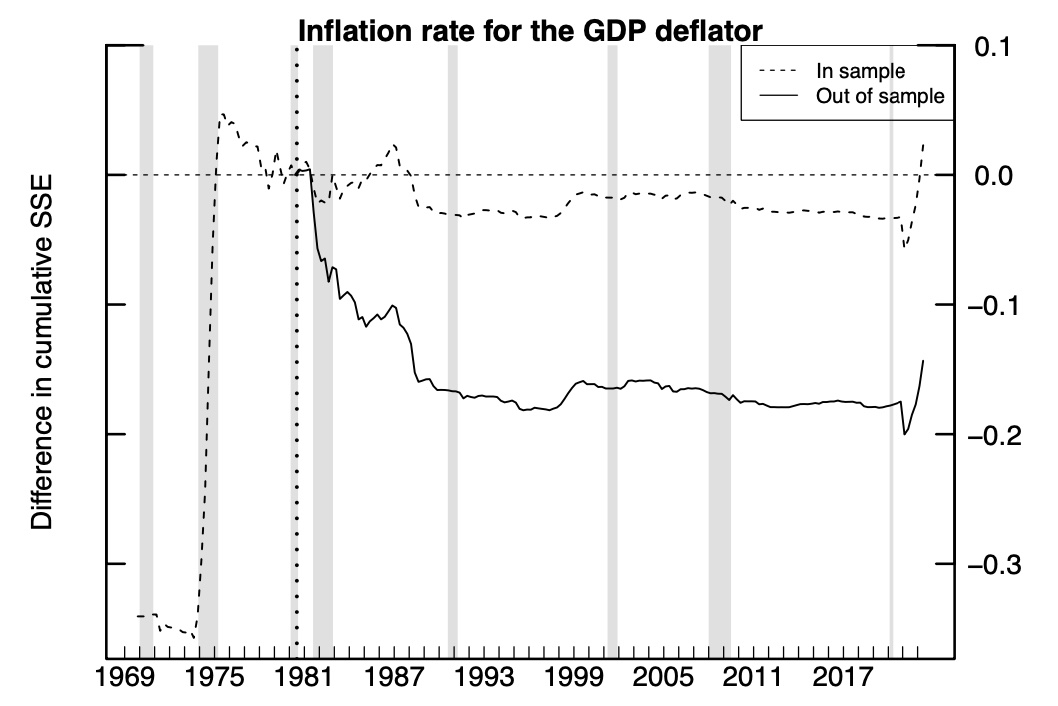

with Fabian Winkler

We revisit predictability of forecast errors in macroeconomic survey data, which is often taken as evidence of behavioral biases at odds with rational expectations. We argue that to reject rational expectations, one must be able to predict forecast errors out of sample. However, the regressions used in the literature perform poorly out of sample in most cases. The models seem unstable and could not have helped to improve forecasts with access only to available information. We do find some notable exceptions, such as mean bias in interest rate forecasts, that survive our out-of-sample tests. Our findings thus narrow down the set of biases that merit the attention of researchers in behavioral macroeconomics.

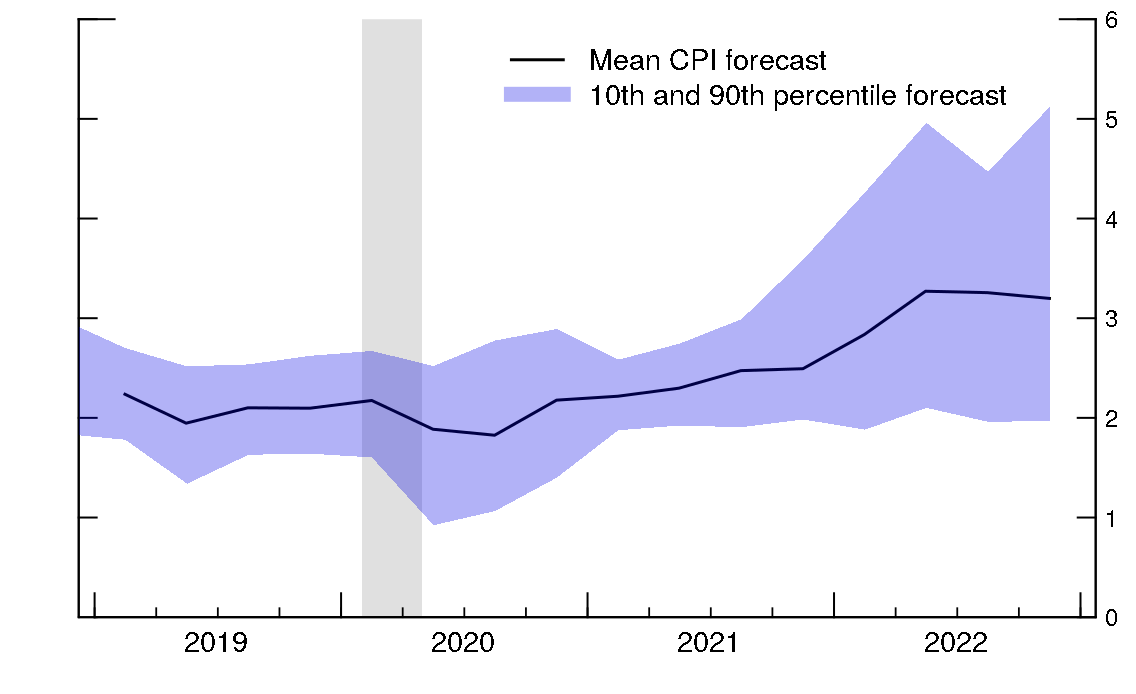

with Michael Lamla and Damjan Pfajfar

We explore whether households are sensitive to different levels of precision of inflation signals and how they incorporate these signals into their forecast. Using a randomized control trial design for the U.S. and Germany we provide evidence that households react differently to information with different levels of precision. Specifically, households respond differently to signals with different precision only in the decision to update (extensive margin) their expectations and not in the size of the adjustment (intensive margin) as postulated by Bayesian updating. We propose a model of households' inflation expectations formation where they are rationally inattentive to inflation news. Not only does this model resemble the empirical result but also shows that in times of high uncertainty elevated inflation expectations may persist because of the signal variance.